What are HOA Governing Documents?

HOA governing documents are the written rules that explain how a community is set up, how it is run, and what owners agree to follow. A lot of daily “Can I do this?” questions, from fencing to parking, end up tracing back to HOA governing documents.

HOA Governing Documents: the Big Picture

A community association can feel simple from the outside, yet the paperwork underneath it is doing real work. HOA governing documents act like the community’s rulebook, job description, and guardrails all at once, so expectations stay consistent from one owner to the next.

Clarity is the goal. When the documents are understood and applied the same way each time, fewer disputes show up and routine decisions move faster. Even in a friendly neighborhood, that steady baseline matters once money, property use, and shared spaces come into play.

Why These Papers Matter

The practical impact shows up in small moments. A paint color request, a noisy party, a new satellite dish, or a late assessment all land in the same place: a written standard that is meant to be fair to everyone.

Protection is part of the story, too. Lenders, insurers, and future buyers often look for signs that an association is organized and operating within its authority. Strong records and clear processes tend to lower stress for the board and for homeowners when a big project, special assessment, or enforcement issue hits the agenda.

Where the Documents Come From

Most sets start with the developer. A planned community is created with recorded property documents and an association that will later be turned over to the owners, so the early paperwork sets the foundation and then evolves as the community ages.

State law sits above all of it. Corporate statutes, community association statutes, and local rules can shape what the association is allowed to do, what must be disclosed, and what procedures have to be followed. Because of that, two communities can use similar documents and still operate a little differently.

The Declaration That Runs With the Land

The declaration is often the most important document for owners because it attaches to the property itself. Restrictions on use, maintenance duties, assessment obligations, and common area rights are usually described there, so it tends to answer the biggest questions first.

One phrase gets used for it in many communities: CC&Rs. That shorthand points to covenants, conditions, and restrictions, which is a good hint about the purpose. The declaration is the place where community standards get tied to ownership, not just to personal preference.

A recorded document also has staying power. Amendment rules are usually stricter here than they are for day-to-day rules, since these provisions affect property rights and long-term obligations.

The Corporate Layer Behind the HOA

Many associations are corporations, even if they do not feel like a “business” to owners. The articles of incorporation are the document that creates that legal entity, which allows the association to hold property, enter contracts, and manage the common areas.

A practical way to think about it is this: the declaration explains what the community is and what owners agreed to, while the corporate papers explain what the association can do as an organization. That distinction is helpful when a board is signing a large vendor agreement or dealing with a bank account question.

Some communities also have maps and plats on file that show unit boundaries and common areas. Those drawings can look dull, yet they often end arguments quickly when a fence line, easement, or parking space becomes a point of tension.

How HOA bylaws Keep Meetings Fair

A lot of boards lean on the bylaws more often than they realize. Meeting notice, voting rules, director roles, and election procedures are usually spelled out there, which means the bylaws are the roadmap for how decisions should be made.

Order is the main benefit. When meeting rules stay consistent, fewer surprises show up, minutes are cleaner, and homeowners can participate without guessing what comes next. Over time, that steady process builds trust, even when the agenda includes unpopular topics.

A useful clue sits in the details. Quorum requirements, proxy rules, director terms, and vacancy procedures tend to live here, so a quick check can prevent a procedural mistake that later unravels a vote.

Rules and Policies for Daily Life

Operating rules and board-adopted policies fill the gaps between the big, recorded documents and the everyday reality of living close to other people. Parking expectations, amenity hours, pet rules, noise limits, and pool safety often land in this layer.

More flexibility exists here, which is why this layer changes more often. Clear drafting still matters, though, because vague rules invite selective enforcement and frustration. A rule that reads well to a first-time homeowner usually reads well to everyone.

A short list of healthy traits helps when the board is reviewing its day-to-day rules:

- Clear purpose tied to safety, maintenance, or neighbor peace

- Plain wording that an owner can understand on a first read

- Consistent treatment across similar homes and situations

- Reasonable deadlines and predictable consequences

- Written procedures for requests and appeals

Approval Paths for Home Projects

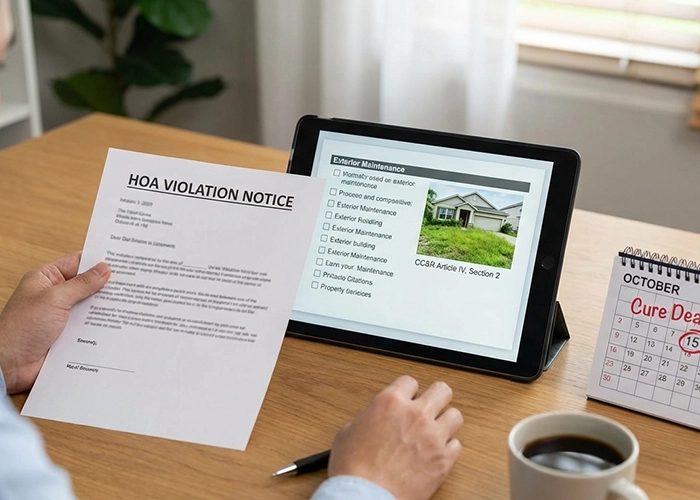

Exterior changes are where many owners learn, quickly, that “my house” has some community strings attached. Architectural standards, design rules, and approval procedures are often spelled out in the governing set, and they can cover everything from fences and doors to solar panels and sheds.

Written approval protects everyone. A quick email or signed form keeps the board from relying on memory, and it gives the homeowner confidence that a future board will not treat the project as an unapproved change. As a result, a simple habit of documenting approvals can prevent expensive rework and a lot of resentment.

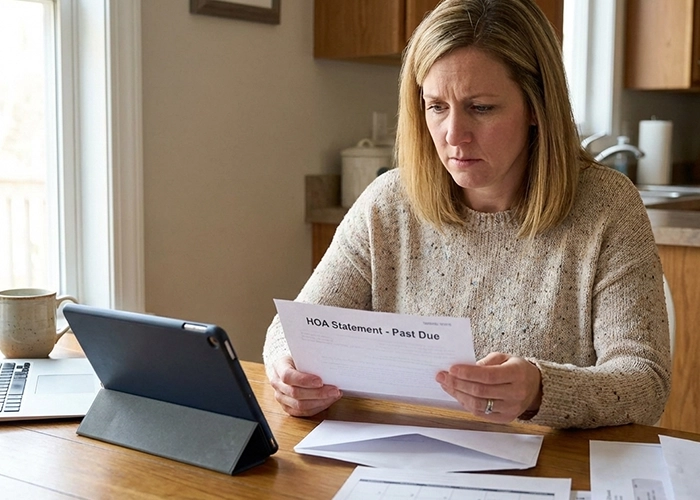

Money Rules That Shape the Budget

Assessments feel like a practical topic, but the authority behind them comes from the documents. The power to levy regular dues, approve special assessments, charge late fees, and pursue collections is typically defined in the declaration and supported by state law.

Transparency matters because money is personal. Clear notice, fair timelines, and consistent application of fees can reduce conflict even when dues rise. In well-run communities, owners may still disagree with a budget, yet the process feels predictable and grounded in the written rules.

Reserve planning is part of that conversation as well. The documents often outline what the association must maintain, which helps the board explain why reserve funding is not optional. When owners can see the link between duties and dollars, budget talks tend to stay calmer.

Fine Print That Trips People Up

A few topics tend to surprise new owners. Rental limits, parking restrictions, work trucks, pet policies, exterior decor, and home business rules often sit in places that get skipped during a quick skim.

The best time to learn about restrictions is before plans are made. A homeowner who reads first can avoid paying for materials that will not be approved, and that owner can also ask smarter questions during a request or hearing. That small shift, from reacting to planning, changes the tone of most owner-board conversations.

Rental rules deserve extra attention if an owner plans to lease the home or use short-term rentals. A quick check can prevent a purchase that does not fit the owner’s plan, especially in communities with caps or approval queues.

Which Document Wins When They Clash

Conflicts happen, especially after years of amendments and “one-off” rules. A simple hierarchy usually applies: law outranks all association documents, recorded property documents outrank internal rules, and board policies must match what the higher documents allow.

The real-world value of hierarchy is speed. Instead of debating opinions, the board can identify which document controls the issue and then apply it. Homeowners benefit, too, because decisions feel less personal when the “why” is clear.

A good practice is consistency in language. When a rule uses terms like “unit,” “lot,” or “common area,” the definitions should match the definitions in the higher documents. Small wording differences can create big confusion once enforcement begins.

Changing the Rules Without Chaos

Change is normal. Communities age, building codes shift, new technology shows up, and old restrictions stop making sense. Because of these, having updates keeps the rules relevant.

Process matters more than speed. A clear amendment path reduces conflict because owners can see how the change is being handled and how their input fits in. In many communities, higher-level documents need a member vote. Meanwhile, operating rules can often be adjusted by board vote after proper notice.

A practical sequence tends to keep updates orderly:

- A clear reason is identified, with examples of the current problem

- Draft language is prepared in plain terms

- Homeowner input is gathered before the vote

- A vote is held using the procedure required by the controlling document

- Final text is distributed and stored in the official record set

When Documents Need a Reset

Age shows up in paperwork. A stack of amendments, conflicting terms, and old references to outdated law can make a community feel harder to manage than it needs to be.

A restatement or careful rewrite can clean up the mess without changing the community’s core standards. Legal help is often part of that work, and member approval may be required, but the payoff is real. Cleaner language, fewer contradictions, and a single “current set” can make governance calmer for years.

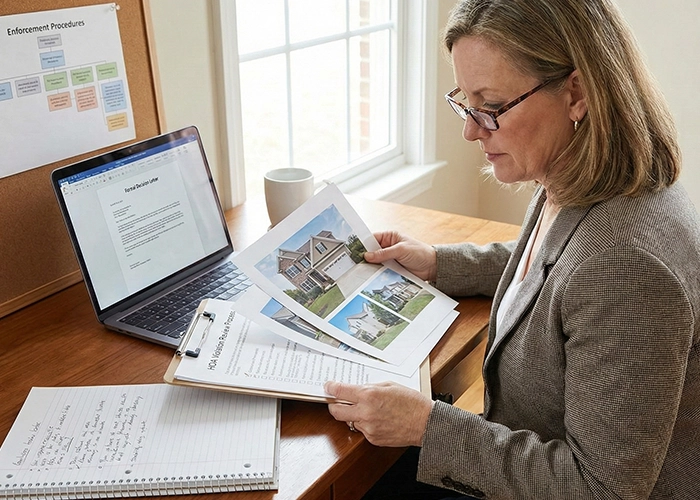

Reading Them Like a Pro

A full document set can feel intimidating, especially when legal terms show up. A better approach is targeted reading, so each section answers a real question and the rest can be skimmed for context.

A good starting point is the “who does what” sections. Maintenance duties, architectural authority, assessment powers, and enforcement tools usually sit in clear blocks, so those sections can be flagged early. After that, notice requirements and voting rules can be reviewed, since those drive how change and enforcement must be handled.

A few questions guide most first reads:

- What changes require owner approval?

- What approvals are needed for exterior changes?

- What can lead to a fine, lien, or other action?

- Who maintains what, including limited common areas?

- What are the dispute and hearing procedures?

Getting Copies and Staying Current

Access should be straightforward, but older communities sometimes struggle with scattered files. A clean set of HOA governing documents usually includes the most current version, every amendment, and any adopted rules or resolutions that are still active.

Many owners first look at their closing paperwork. That helps, yet closing packets can be incomplete or outdated. Because of this, the association should be treated as the source of record. A management company, association portal, or board secretary often maintains the official set.

Consistency is the long-term goal. A single folder system, a clear naming convention, and a habit of saving final, approved versions can prevent years of confusion later. When a dispute arises, the time saved by good records is felt right away.

Enforcement That Feels Consistent

Enforcement is where documents become real. When the board uses the same steps for each owner, and when notices point to the right rule, the process feels less personal and more predictable.

Due process belongs in the mix. Notice, a chance to be heard, and a written decision should be part of the pattern, especially when fines or other penalties are involved. Fair process does not remove all disagreement, but it does reduce the sense that enforcement is arbitrary.

Communication helps more than people expect. A short explanation of the rule’s purpose, a clear deadline, and a simple path to request an exception or correction can turn a tense moment into a routine fix.

A Manager’s Role in Document Health

Professional support often shows up as organization, not as flash. A manager can keep versions straight, track adoption dates. They also ensure new homeowners receive the same core packet.

A second value is process discipline. Meeting notice timelines, hearing procedures, and document retention practices can stay on track when someone monitors the calendar and maintains a consistent workflow. The board still makes the decisions, but the follow-through becomes easier.

Good management also supports long-range planning. Regular reviews, consistent enforcement logs, and clear policy writing can reduce risk and make future board transitions smoother.

Rules in Action

A well-run community depends on more than good intentions, and the paperwork is part of that reality. With HOA governing documents kept current and used consistently, the association can make decisions that feel fair, clear, and easier to live with.

Looking for professional help with creating or amending your HOA governing documents? Personalized Property Management offers HOA management services around Southern California. Call us at 760-325-9500 or email us at info@ppminternet.com for more information!

Related Articles: