Buying a home in California isn’t easy, more so for veterans trying to break into a market known for steep prices and tight competition. That’s why the VA loan program stands out, as it’s designed to give those who’ve served an edge when it comes to securing a home. But not every home qualifies, and the process can get tricky in HOA communities.

What is a VA Loan Exactly?

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs. It’s meant for veterans, service members in active duty, specific members of the National Guard and Reserves, and some surviving spouses. What makes it special is that you can buy a home without putting any money down—and without having to pay private mortgage insurance (PMI).

Instead of lending directly, the VA guarantees a portion of the loan. This backing gives lenders more confidence and often leads to better terms for you as the borrower. That’s a big deal in a state like California, where the cost of entry into the housing market is high.

Why Do VA Loans Matter So Much in California?

In most parts of the country, skipping the down payment is a helpful perk. In California? It’s a game-changer. Median home prices often hover well above $700,000, and in many areas, they’re even higher. For someone using a conventional loan, that means needing to save six figures just for a down payment.

With a VA loan, you can buy without putting anything down and still skip the monthly cost of PMI. Your savings from it add up fast, especially when you’re also budgeting for HOA dues, Mello-Roos taxes, or other community fees.

The VA loan also allows eligible buyers to borrow large amounts, sometimes exceeding $1 million, as long as they qualify based on their income and credit. No extra hoops. No jumbo loan down payments. Just the same no-money-down benefit, even on higher-priced homes.

What Sets the VA Loan Apart From Others?

Here’s why so many California veterans rely on it:

- No down payment – Needing to have money for a down payment is often the biggest barrier to entry. Luckily, this loan removes it.

- No PMI – Most low-down-payment loans require PMI, which can easily be a few hundred dollars a month. With a VA loan, you skip it entirely.

- Competitive interest rates – Because of the VA backing, lenders often offer better-than-average rates.

- Flexible credit requirements – When applying for this type of loan, you don’t need perfect credit to qualify.

- Limited closing costs – The VA puts caps on what lenders can charge.

- Reusable benefit – You’re not limited to just one VA loan in your lifetime. You can use it again if you meet the guidelines.

To put it simply, applying for a VA loan isn’t designed to be a backup option. Instead, it’s one of the best loan products out there.

How It Works in California

The loan itself works the same no matter where you live, but California’s housing market adds a few wrinkles.

One of the biggest? High home prices. In counties like Los Angeles, Orange, and Santa Clara, standard homes often exceed conventional loan limits. But with a VA loan and full entitlement, that’s not a problem. You can borrow above those limits without needing a down payment, as long as the lender approves you for the full amount.

Then there are the state-level perks. In California, you can also find the following offers:

- CalVet Home Loans – A separate program through the California Department of Veterans Affairs. You can’t use both loans on the same property, but it’s another solid option for eligible buyers.

- Property tax exemptions – Disabled veterans may qualify for significant tax relief, depending on their income and disability rating.

And don’t forget to factor in HOA dues and local assessments. These are common in California and can affect your loan approval since they’re counted in your debt-to-income ratio.

Using a VA Loan in the Coachella Valley

The Coachella Valley is a popular landing spot for veterans, especially retirees. With sunshine, golf courses, and a slower pace of life, it’s easy to see the appeal. But the area is also full of HOA-managed communities, which bring their own set of rules.

Most single-family homes and townhomes are eligible under VA guidelines, but many condos aren’t—unless the VA has officially approved the development. If you’re looking at a condo, you’ll want to check that list early. It can be the difference between a smooth loan and a dead end.

Also, properties on leased land are common in this region. Unfortunately, homes on leased land are usually not eligible for VA loans, which could limit your options in some neighborhoods.

That said, plenty of communities in the Coachella Valley are a good fit for VA financing. The key is knowing where to look—and working with people who know how the process works.

What is VA Loan vs. VA Mortgage?

They’re the same thing. Some lenders or websites might call it a VA mortgage, others a VA home loan. It all refers to the same government-backed loan program.

Whether you’re reading a loan estimate or a listing online, don’t overthink the wording—just make sure it’s a VA loan product and that the lender is VA-approved.

What Kinds of Homes Can You Buy?

Here’s where things get a little more specific. The VA has rules about what types of homes you can buy, and those rules are especially important in California, where condos, HOAs, and alternative property types are common.

Primary Residence Only

This isn’t for investment properties or vacation homes. You have to live in the home as your primary residence.

Single-Family Homes

The simplest option. These homes usually meet all VA requirements and don’t need extra approvals.

Condos

Here’s the catch: the entire condo development must be VA-approved. If it’s not, your lender can sometimes help apply for approval, but that takes time and isn’t guaranteed. Always check the VA’s condo list before falling in love with a unit.

Planned Unit Developments (PUDs)

These are communities with shared amenities and HOA oversight, like townhomes or gated neighborhoods. Most are VA-eligible, assuming the unit itself meets basic property guidelines.

Manufactured Homes

They’re allowed, but they have to be permanently attached to a foundation, meet HUD standards, and be considered real property. Not all lenders finance them, even if the VA allows it.

Multi-Unit Properties

VA loans can be used for duplexes, triplexes, or four-unit homes, as long as you live in one of the units full time.

Leased Land

This one’s tough. If the home sits on land you don’t own (common in resort communities or mobile home parks), it’s usually not eligible for a VA loan.

Bottom line: not every home is eligible for a VA loan. Before making an offer, ask your agent and lender to verify the property’s eligibility.

Applying for a VA Loan in California

You don’t need to be a loan expert, but it helps to understand the basics before you dive in. Here’s a breakdown of how to get started.

Step 1: Check Eligibility

Start by confirming you qualify. That usually means 90 days of wartime service, 181 days during peacetime, or six years in the Guard or Reserves. Surviving spouses may also qualify. Once you’re eligible, get your Certificate of Eligibility (COE) online or through your lender.

Step 2: Get Preapproved

The next step is preapproval. This is when the lender reviews your credit, income, and debts to figure out what you can afford. It’s also when you’ll learn how HOA dues or property taxes might impact your loan.

Step 3: Find the Right Property

You then need to look for the right property based on your needs and preferences. Work with an agent who knows the local VA landscape. They can help you avoid ineligible properties, especially important in areas with lots of HOAs or leased land.

Step 4: Appraisal and Underwriting

A VA-approved appraiser checks the value and condition of the home. Underwriters then review your full file to ensure everything meets guidelines.

Step 5: Close the Loan

Sign the paperwork, get the keys, and move in. You’ll need to occupy the home within 60 days (extensions available if you’re deployed).

A Quick Note

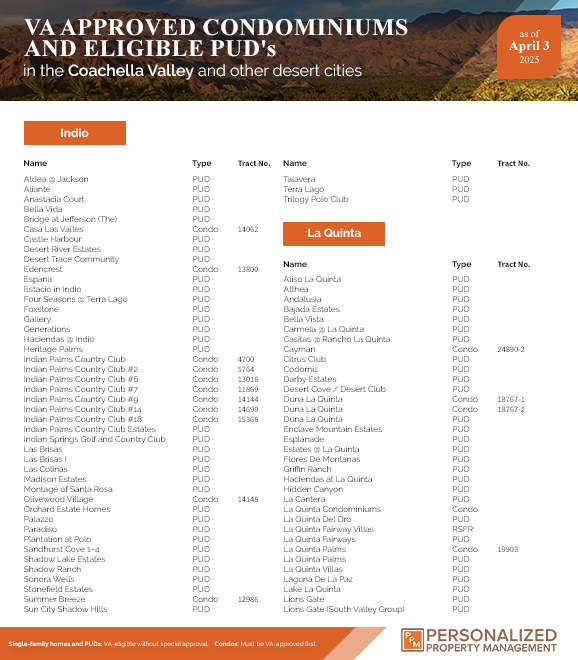

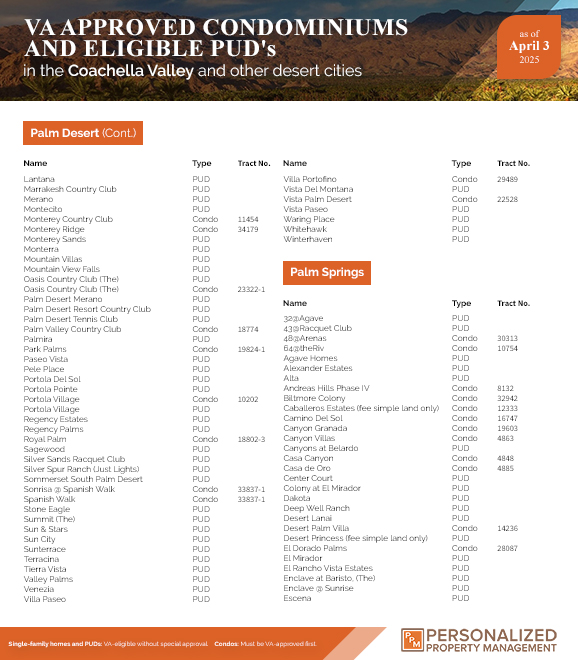

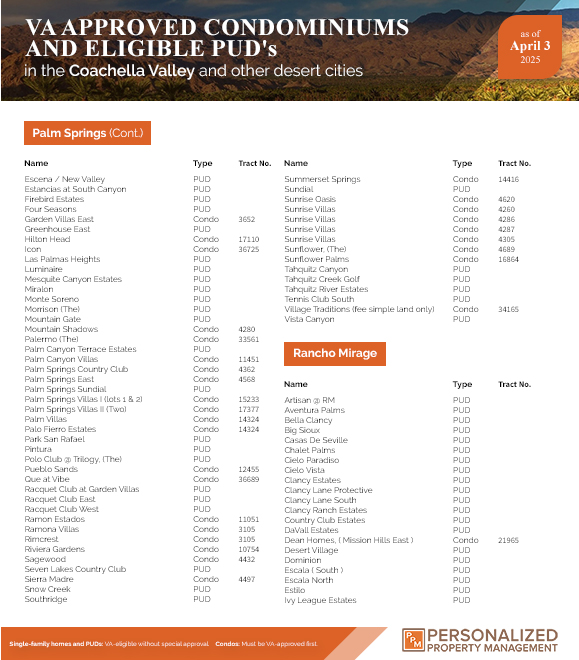

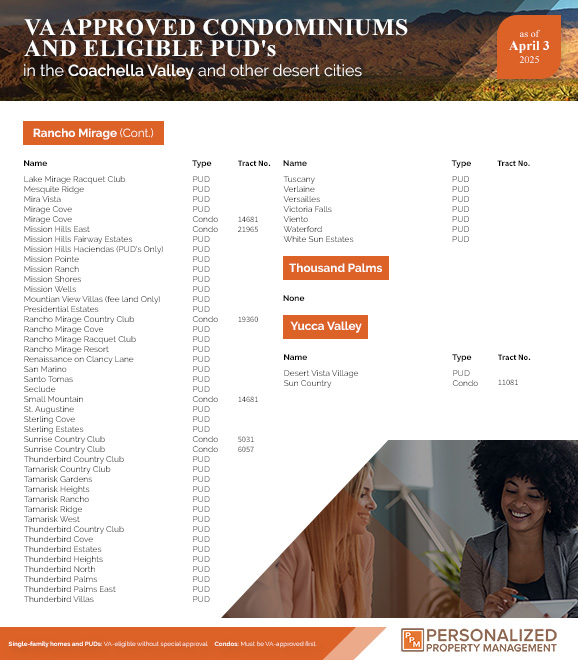

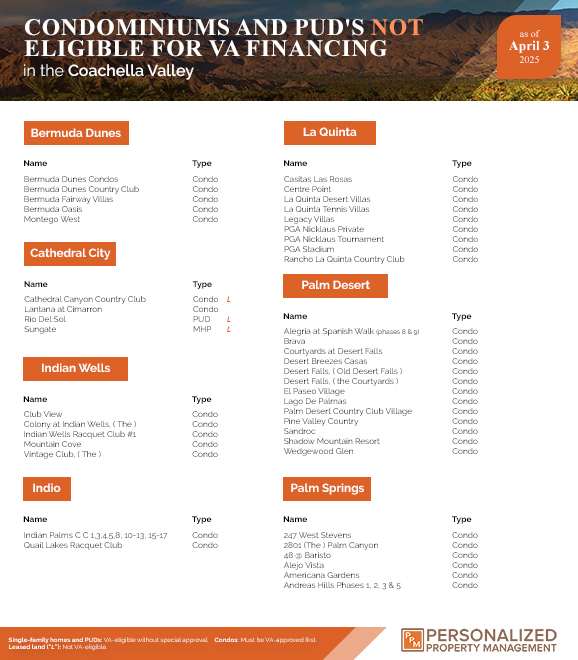

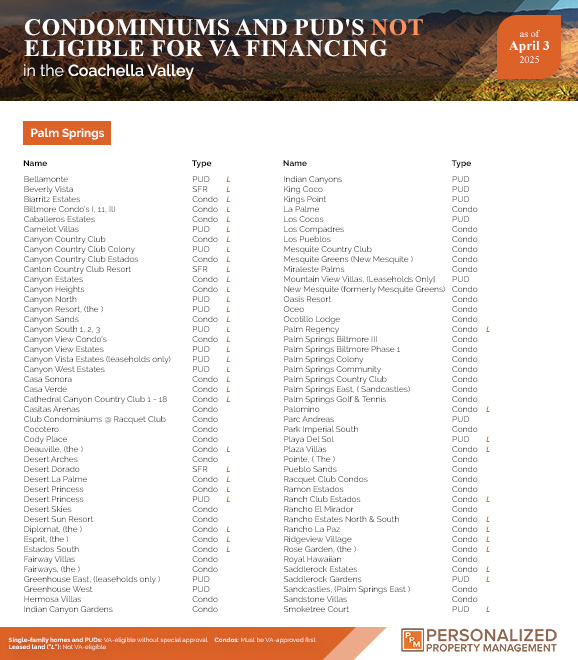

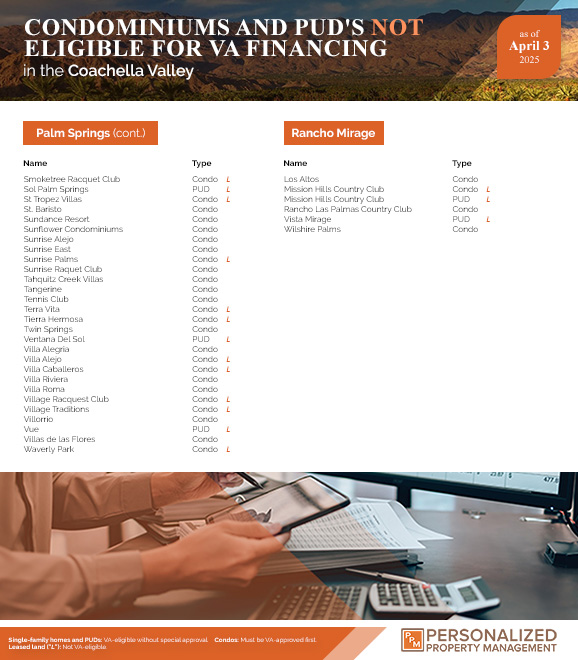

To make things easier for local buyers, Personalized Property Management put together a simple guide that outlines which properties in our managed communities are compatible with VA loans. It includes a clear legend and was last updated on April 3, 2025. If you’re looking at one of our communities and want help confirming eligibility, reach out.

VA Approved and Eligible Condominiums and PUDs in Coachella Valley

Not VA Eligible Condominiums and PUDs in Coachella Valley

Navigating VA Loans in California

The VA loan can make a real difference, especially in a place like California, where every dollar counts. You’ve earned the benefit. Now it’s just a matter of using it wisely.

Do you need help in managing your property? Personalized Property Management offers HOA and property management services around Southern California. Call us at 760-325-9500 or email us at info@ppminternet.com for more information!

Related Articles: